The property arm of a well known Household and Consumer brand (name had to be removed on request) is expected to launch their new residential apartment project on Whitefield Main Road opposite Brigade Metropolis en-route to ITPL. The high rise residential project spread across ~ 8 acres will offer apartments in 2, 2.5, 3 & 4 BHK configurations including pent houses. Earlier in May 2013 the property group had entered into an agreement to develop the property belonging to United Oxygen Private Limited.

Options

- 2 BHK

- 2.5 BHK

- 3 BHK

- 4 BHK

Location

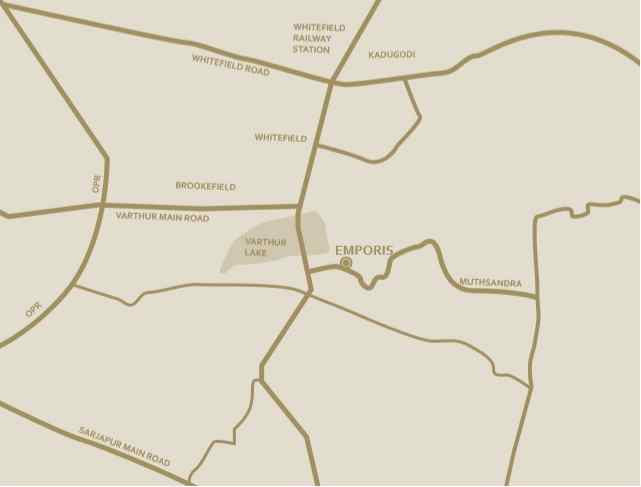

Opposite Brigade Metropolis, between Decathlon and Bhoruka Tech Park

View Larger MapPrice

As of Feb 17th 2014, Rs. 4999/- special launch price valid for first few bookings only

[suffusion-widgets id=3]

Finally it is confirmed that the project will not be approved in current state and it will have to keep reserve space for the Metro.

Total waste of investment for more than 1 year and even 17 floor permission is also a concern. Booking was done till 9th floor or so.

ppl dont do risk assessment and overpay neglecting the risks,because they expect more and more growth on top of existing price.

correct. they are widening this road and project future is dark

Gautam, could you please give us an idea about the source of your information?

@Gautam what is the source of your information I am a buyer of Godrej united and want to ask from where are you getting these information.

How does future of this project matters? Investors of this project are already became rich, on papers. Isn’t that enough?

@pranay @R @Rajesh A ..Hey you can check with the sales office sitting there in Godrej United, they are now disclosing that the roads will be widened and if you want you can visit the Lavelle road branch also to get more insight. The information is now open and accurate.

Metro is in news from more than 3 years now. I am sure those who booked, must have factored this before decision making.

BDA may increase FAR and give some compensation to the land owner. Net net in worst scenario it may reduce the undivided land share of owners.

Good if owners can push builder to compensate for same (highly unlikely)

Good Point Kalpesh

Dear Mr. Gautham,

There is no impact on the residential development of the project due to proposed Bangalore Metro Rail Corporation Limited (BMRCL) work. We request you to please share your contact coordinates with us on . We will be happy to resolve any query or concern that you may have on Godrej United.

We also request you to refrain from posting unverified information that could mislead the patrons of this forum. Godrej Properties believes in a relationship based on trust with its customers, and we look forward to assisting them in their home-buying process.

Regards,

Godrej Properties Limited

@godrej properties limited Please dont deny that roads are not to be widened. I am not sure how your residential and future development is composed and divided. I am 100% known that roads will be widened. Also rather than posting to webmaster why dont you tell me here why you guys are not getting approval and you have delayed the project from feb 2014 till now in pre-launch phase.

Dear Godrej Property team, I must say your response is hilarious – the project has not yet been officially launched, the construction work is progressing at a snail’s pace (if not stalled), all approvals are not in place and you mention that there is no impact to the residential project. Yes, there may not be any impact to your profits, but there is a definitely a negative impact on the customers with the various delays !

“There is no impact on the residential development of the project due to proposed Bangalore Metro Rail Corporation Limited (BMRCL) work. ”

Does it mean the proposed commercial area is impacted?

What is the implication of the latest news in TOI on Kadugodi forest land ?

http://timesofindia.indiatimes.com/city/bengaluru/Industries-in-Bengalurus-Whitefield-likely-to-be-shoved-out/articleshow/47135151.cms

Which area will come under this? Are any residential projects / IT parks going to get affected?

@Prashant, I was thinking the same today after reading TOI. So it is quite possible that industries have to move out, there will be a petition in the courts for years to come and after that we can see the final outcome. Also there will be a land surplus as forest department will give away some of the land as it is urbanized as such due to industrialization. Immediate effect would be price will come down particularly in kadugodi.

Above all there will less truck movement from hoodi circle towards city …( whitefield main road leading KR puram etc)

This is the more recent communication that I received from “reputed” Godrej united properties:

Greetings from Godrej Properties!

We have been working very closely with the authorities on updating certain supporting documents, required by the officials to release our approvals for the project launch.

Given that this prime piece of real estate was purchased years ago, it has taken time for the concerned public administrative offices to update these old records. Further we were not made aware, at the onset, of certain conditional updates specific to the conversion of the land to Residential status. Hence, these procedural challenges have set us back a few months.

However, please be assured that the updating of old records is only a procedural requirement. While BDA has cleared our Development Plan in Jan 2014 and issued the Demand Notice in March 2014 (Uploaded on our website), the clearance was contingent on updating these supporting documents. While we have completed those formalities, a final consent from the Tahsildar’s office and the land records office is received. The file is pending approval in the Deputy Commissioner’s office and we are confident of receiving clearance and releasing the development plan in the coming few weeks.

We would like to reassure you and highlight that most of the other approvals required for commencement of construction have been obtained several months ago. Also several leading banks have given us legal clearance for home loans (Uploaded on our website).The mass excavation of the site has also started in full swing, and this activity will help compensate towards the timely delivery of the project.

Once again, we thank you for your patience and for your continued patronage at Godrej United. We are grateful to every one of you for the overwhelming sales in the project and as an organization we strive to safeguard the interests of all our customers and stakeholders, and believe in complete transparency.

Should you have any query or require any assistance, please feel free to get in touch with our personnel as indicated below.

Ms Kamala, Sr Manager, Customer Care

or

Ms Sunaina Kohli, Sr General Manager, Sales & Marketing

We wish you a great week ahead!

Regards,

Godrej Properties Team

Dear Team Godrej,

Will you pay penalty to your buyers for this delay?

Though the agreement is not yet done but still you know it well that the buyers are at loss of rental due to inordinate delay.

Being an ethical company are you ready to compensate for the delay or leave your buyers/investors like other 3rd class builders who only care for minting money?

Kumar

builders collect the interest free money to pay the land owners share..but the land owner might be asking more..so discussion might be happening with the land owner..

since this is a listed company..would suggest everyone to raise the issue with SEBI..for delisting from the market..they cannot show the amount collected in the accounts are revenue generated..

also file a case in consumer court for speedy response

It is exactly one year since Godrej “Pre-launched” this property. Till date they do not have a firm date when they will have all the approvals and project will be launched formally. Much smaller builders are much better than this so called “Tier 1” builder.

@Amit

How does it matter? One more ad. in TOI, and prices go up by Rs 200 per.sqft.

That fine morning, all the stake holders get rich by few more lakhs. Why do want approvals and a formal launch of the project. They are all unnecessary formalities.

Investors are more interested in price appreciation and not in what’s on the ground.

launch got stopped because of the upcoming metro work..the place is going to be another hell till the metro work gets completed..be careful..

What is the source of this information?? It will help folks.

Investors cannot build castles in thin air forever. They also need approvals to be through and construction to be started to exit and make money from this “investment”. For end users, they have paid interest free money to so called “Tier 1” builder without any commitment.

So called “Tier 1” builder is laughing all the way to the bank.

@Amit

>>>>They also need approvals to be through and construction to be started to exit and make money from this “investment”.

Ahhaa. I agree with you. But please understand, as long as the property is “appreciating”, why would anyone like to sell it? Is this not the very wave of price appreciation that every investor wanted to ride and for which they are into the game?

Property prices appreciate the most between pre-launh and formal-launch. If pre-launch gets extended, it only means more appreciation. If you are an investor, why to demand a formal launch? Just be happy seeing full page TOI ads. announcing new rates. If anything, such ad. makes the day for the investors. Being “rich” by few more lakhs, they immediately “start felling lucky and proud” about their investments. Raising the toast that evening, they tell their friends: Didn’t I tell you: “Manjushree”—that gadfly on HarshaSagar—was damn wrong.

And then a point arrives, when there is nothing on the ground but the prices are already sky-high. New investors–and home-buyers–don’t turn up as often. At this point, builder needs something on the ground to justify further SPECULATION. They bring about some govt. approvals or starts digging the mud. Obviously, such “ground work” is done only when there is a need to bolster further speculation and to lure in new customers. Otherwise, no one minds.

This cycle goes on and on for 2-3 years. Prices go flat at this point and you don’t see as many ads. Investors now decide make the cut and book profit. They list their “investments” at Rs 100 per sq. ft. less than the builder’s current selling price. After few months of hard search and bargain, they realize how difficult it is to exit even after doling out a discount of Rs 500. Only buyers they find are the ones who are ready to buy only at the price points at which they themselves entered.

But for these investors, after adding borrowing cost (interest part of the EMI) and the opportunity cost, the actual cost of ownership stands at least at 20% more than the price at which they entered. How can they sell for a 20% loss? So, they keep on holding on to these “bad ester eggs”, hoping some day market will improve and they will get a buyer. Will they?

With a glut of unsold inventory, only time will tell, who makes the real money.

@Manjushree, I understand market dynamics – but I put money for end use hence my discomfort for delay in getting the project getting started. For the same reason, I went with so called “Tier 1” builder.

Godrej properties has one of the largest land banks in India. In Mumbai, no other builder has a larger land bank than them. They have very deep pockets and are smart enough, to not dip into the same and start a project. They will take money from investors/buyers and only start a project, which is absolutely fair thing to do.

So hold on for some more time, and await the incentives like 80:20 schemes/ free summer holiday packages/ free modular kitchens etc, which will take them closer to their targets, and then ensure successful launch.

Please be advised Godrej is NOT the builder of the project. They are only the development manager/branding partner. The builders are the owner of the land United Oxygen.

I agree – pre-launch from Tier 1 builders are very risky. First of all, the money is blocked for a long time, and then when the project is finally launched, you do not get a choice of apartments. Had a bad experience with Brigade Lakefront, which was also in pre-launch for 1.5 years. Had to withdraw, since the units opened during launch was not matching requirements. On a positive note, Brigade promptly refunded the money with interest. Not sure why Godrej United is delayed – maybe some issues with profit sharing with United Oxygen or approval issues wrt project. There should be some law regarding pre-launch – it should be for a max of 6 months or so.

It seems this project would shortly enter the record books as the longest in pre-launch…Builder might use this dubious distinction and hike the price further…! My straight question is this: Why is the Govt not demanding any answers from the Builder for the delay? What is the overall delay in the possession of this property? Would the builder compensate the buyers for this delay? Someone has to demand answers from the Builder…

You are right. Projects which are pre-launched after Godrej completed 30% work.

Did Godrej complete Excavation at least.

Is there big rock in this area. I hear rock drilling sounds.

Anyone saw what’s the status of construction.

Agreement s started. How much % is collected till now, only booking amount or 20% for agreements?

It has almost been a year since this project was pre-launched. I guess it is still in the pre launch stage. When will construction begin ? When are they going to get the approvals. What is the current price now

@advait

For these “renowned” builders, prices are no way related to construction.

Prices depend on when they plan to put up a full page ad. in Times of India. And the price mentioned in that ad. immediately becomes the current price. This is how RE investments appreciates in today’s market, and this is how new money is generated in modern times.

Imagine, with just an Ad., all the stake holders get rich by few more Lakhs. All these has nothing to do with construction, govt. approval or anything else.

@Manjushree,

I have been frequenting this site to read through your various comments.Your comments are always spot on. Echo my thoughts to the tee.

Every time, I see unrelenting ads/bill boards with cheerful faces and tall claims, I shudder thinking if it is really only me who is put off and scared in pursuing them? And all others are doing so well that they can indulge in buying exorbitantly priced flats?

But I am willing to play safe by staying away. There are other options to make money work.

RE is not a good investment at alll.we will have maintence expenses whether we live or give it to rent…the yield is very less..so its better to avoid.

Is this project still in prelaunch? What is the price for 3BHK. Is the per unit price for 3BHK same as that of 2BHK or do we get some discount on account of larger investment?

Ramesh – Project is still in prelaunch, Phase 1 is @ 5900 and Phase 2 is @5650 . Base price is same for 2BHK and 3 BHK in phase 1 and 2 . Feel free to mail me if any more question.

Paddy@@ i have invested in one bhk at this project could please tell me seeing the development n the area will the prirce apprecaite to 7500 by 2016 end

and how do you see the demand for one bhk for sale in whitefied

Venky@ it is great investment the returns for one bhk will be excellent

By 2016 end the expected price will be 6500 to 7000

Venky@@ the demand for one bhk will be there since only brigade metropolis and Godrej have one bhk in this area

With one bhk at Godrej at a premium luxury segment the demand for a one bhk will be very high

Just relax and enjoy the return on the investment

The way real estate market works is, even if the sales are down the builders will try to keep the prices up or atleast stable as long as possible for them. Its not like a stock market you will get immediate crash. They will start cutting prices when it becomes painfully obvious to them that the prices they quote they wont get in the years to come. Surely it will happen at some point in a bubble zone. In 2006 end , US real estate association declared that there was no bubble in US realty. What happened in a year?

There is no safe asset that can give 30% returns year after year in the world. If yes, even google will invest in such assets rather than running a company

Find out:

Why prices are not coming down even when sales are down by as much as 43%?

What role Banks play in keeping the prices artificially high, and What do they gain out of it?

And, finally, what’s the kind of response you can expect from retail investors as the RE market slides downhill?

Read my latest write-up here:

http://harshasagar.com/2011/06/09/prestige-tranquility/comment-page-5/#comment-31095

Price will never come down until we have corruption..

Its like chain..

1. Govt people ask bribe for everything every time and they increase the value..

2. Near property cooperator, MLA, Gunda ask builder to pay the money..

So obviously builder will not pay fom his pocket…It will come from out pocket…

I don’t want to demotivate anyone but this is the fact my point of view…

Hope india future will improve at least my generation..

One more thing about Godrej..

When I enquired 2 BHK apt in united they said all are sold out…

I was laughing, Still construction not started 2 bhk sold out..

This is marketing tricks to sold out first old and highely prices apts and later 2 bhk with higher price which would easily sell it out becoz more demand..

So advise pls don’t believe these marketing guys they make fool..

@deepak

Good thing about corruption is that it follows conventional economics of demand-and-supply. If RE demand is down, so will be the money demanded for corruption. Money paid—and incentives received in return—by corruption is mostly upfront, so no speculation there.

However, for banks, they have Harvard educated GAMBLERS and tonnes of money to game the system. These guys can conjure up charts and graphs predicting another RE boom in the near future and thus justify current prices.

By now you should know, when it comes to predicting the future, these GAMBLERS are no better than astrologers. But you are right: Prices will not come down immediately.

This gamble will go on for quite some time.

Does the godrej united has KIADB converted land ?

If yes, then there might be some legal issue in the future because of the new govt rule mentioned in the link below.

http://www.deccanherald.com/content/436883/govt-bans-use-kiadb-land.html

Dear Ashish,

Greetings from Godrej Properties Limited!

Thank you for your interest in Godrej United, Bengaluru.

With regards to your query, we would like to inform you that the land belonging to Godrej United residential property is not on KIADB allotted land accordingly the revised policy does not affect us.

Godrej Properties always believe in a relationship based on trust with our customers.

Should you have any further query in making an informed decision please feel free to write to us on along with your contact details we shall be glad to assist you with the same.

Regards,

Godrej Properties Ltd.

Got the following SMS from Godrej United:

“This Diwali, book your dream home at Godrej United, Bengaluru and get 8 gm gift of Gold along with the special prelaunch price. Call 080-XXXXXXXX. T&C Apply”

For the Last 2 days, received 5 such SMSes. Looks like they are still in prelaunch since a long time. Prelaunch till they get some bakras?

For 8 gm of Gold, one has to invest 1+ Crore 🙂

friends..gold prices has come down very much..then 8gm is not enough..

I guess Brigade is also attracting buyers with ‘golden’ offers ! Received an email for Brigade Meadows which promised Rs 50000 and Rs 75000 worth of gold for booking a 2bhk and 3 bhk resp. I guess these are signs of market slowing down – also, have observed that the so called reputed builders charge heavily but provide less carpet area. In these respects, maybe some non-so big builders could prove a good buy – spacious apartments in less price. What do you guys think? Of course, such builders need to be evaluated carefully before proceeding.

If people are genuine and wanted to live happily..please go ahead and buy any property..you may negotiate a better deal

If you think of investing and taking 50 % profits..then god only can help. Market is saturated and people will have lots of choices.

Dear Vinay,

Greetings from Godrej Properties Limited!

Thank you for writing to us.

As part of the special offerings during Diwali, we were running this limited period offer to make the home-buying experience during the festive season an even more memorable experience for our customers. To spread awareness about this benefit, we did send an SMS to people who had in the past enquired or evinced an interest in Godrej United.

Should you have any query in the future, please feel free to write to us on our customer response team email along with your contact details.

We will be present here to provide our assistance to your utmost satisfaction so that it will help you make an informed decision.

Regards,

Godrej Properties Ltd.

Can you update on launch date?

I think the answer to the launch date is beyond anyone to answer – probably because the answer would not involve any general statements that are not backed by facts. Builders are not good at such areas.

Dear Bikram & rhr,

Greetings from Godrej Properties Limited!

With regards to your query, we are pleased to inform you that we have received Environment Clearance Certificate from the Ministry of Environment & Forests and are confident that with this development, we would be receiving subsequent approvals to launch the project very soon.

We are also delighted to announce that Godrej United has been awarded ‘IGBC Green Homes Pre-certified Gold’ by the Indian Green Building Council (IGBC). This certification demonstrates our intent to design and build a high performance residential building in accordance with IGBC Green Homes criteria.

Should you have any further query in making an informed decision please feel free to write to us on along with your contact details we shall be glad to assist you with the same.

Regards,

Godrej Properties Ltd.

What are the other approvals pending for this project?

Dear Amit,

Greetings from Godrej Properties Limited!

With regards to your query on approvals concerning Godrej United, please help us with your contact details on and we shall be glad to assist you with the same.

We would also like to apprise you that all the documents pertaining to the approvals received so far for the project are available for viewing on our official project website under Download option .

Godrej Properties always believe in a relationship based on trust with our customers.

Regards,

Godrej Properties Ltd

Dear Godrej Properties team,

Thanks for the response – it has proved my comment right. That builder community is unable to answer a straight forward question with a straight forward answer. The question was on launch date, instead of providing a date, the answer was on certifications received by the builder. With this pre-launch almost reaching 1 year, we are only concerned with the launch date…other details hold no meaning. With a price tag of Rs 6800 +, we expect this project to be the best. No great deal on that.

hi All

I have booked a 2.5 bhk in Godrej United, but i am now looking for exchanging it with a 3bhk. Is anyone interested in exchanging their 3bhk with a 2.5 bhk. please let me know.

Rohini

Whats the size of your 2.5 BHK ?

Size of 2.5 BHK is 1544 Sqft

Please call me on 7259041145.

Regards

Prakash

New unit sales in Bangalore have slowed down 40%to 11,519 units in quarter ending June 2014 from 19,256 in quarter ending June 2013. This has led to increase in unsold inventory to 92,263 units which is nearly 24 months’ worth of unsold inventory

Number of new unit launches has steadily come down in last few quarters in Bangalore registering only 9,746 units launched in quarter ending June 2014 compared to 26,469 units launched in quarter ending June 2013.

So, with this, Bangalore already has 2 years stockpile of apartment units waiting to sell….

Full report at:

http://www.proptiger.com/blog/realty-check-performance-scorecard-of-bangalore-in-the-first-half-of-2014/

hi All

I have booked a 2.5 bhk in Godrej United, but i am now looking for exchanging it with a 3bhk. Is anyone interested in exchanging their 3bhk with a 2.5 bhk. please let me know.

Rohini

I feel property is the biggest CON game played out throughout India. Things were not this crazy 10 years back. Now everybody thinks they can double money in 3 years through plots and flats.We have many TV channels running to spread hype.Before an IT park comes and an engineer gets his first paycheck before working in it, prices are escalated to the roof so that even engineer working in IT park will look poorer. This frenzy is seen in small towns all over India in past 10 years. Flats depreciate over the years. May be, 1 out 10 ppl looking for older flats say 10 years or 20 yrs old. So everyone wants to sell after 4 years-7 years. How many can succeed?This is a CON game.You buy, not to live,not for rental values, but get an idiot paying an extraordinarily high cost to buy from you. Salary of people certainly not risen 5-10 times in the past,as property has done.

Casino mentality has plagued the real estate market. After spending stupendous amount of money in advertisements and other gimmicks, builder are ultimately creating hype to support the exorbitant prices. Obviously, after spending so much, they compromise on quality, project deadlines, amenities and floor plans. And at the end, the investor gets a match box costing him over a crore. But the investor is hardly bothered, as he is convinced that, riding on this hype, it should be easy enough to find a fool who will be more than willing to buy his property at an even higher price. And that’s the reason, in a A-Grade builder project, more than 80% buyers are investors, willing to gamble in a bid to make quick gains.

The point to think is that: if there were not many end users at lesser price, how can you expect them when the prices are hiked. It should take years to justify that high price for the end users to show up. And, that’s the reason, we see so many unsold properties all over up for sale. These properties are not even generating rental incomes. As a 10 years old project, Prestige Shantiniketan is a good example of this phenomena, where even today, 450 odd flats are up for sale and 580 available for rent. Check the latest numbers at:

http://www.commonfloor.com/prestige-shantiniketan-bangalore/povp-s6yjsx

But there is more to this INVESTMENT story. As bala rightly pointed out, apartments deteriorate and, for that reason, there are hardly any end user who is looking for a property older than 10 years. So, the investors are in a pressure to sell it in 4 to 7 years time. But until they sell, they are losing out big time. Read my related post on this topic. Find here:

http://harshasagar.com/2014/02/17/godrej-whitefield-road/comment-page-1/#comment-28563

As these investors BLEED, the pressure is building up. There are many properties which are older than 4 years and investors are trying hard to sell. Now, as these properties get older and deteriorate, and more “investors” join this party, RE market WILL collapse. When will it happen … we don’t know yet. Nobody does. But, that’s inevitable considering that, going forward, IT pay hikes are not going to match the real estate demands. IT is facing substantial consolidation, with demands mostly flat. Major pay and job cuts are forthcoming. And as it rolls out, these investors will be in a frenzy to sell. Prices will collapse then ….

But than, it’s a gamble. It’s OK to lose …

Manju, I am not sure why you are so much against the property market. I see that probably you dont know much about Prestige Shantiniketan. The reason 450 flats are up for sale is that land owner had 8 towers in the project and each tower has around 144 flats. He is not in rush to sell his flats. He opens one tower at a time and opens 2nd tower once he has sold30-40% in the first. He doesnt negotiate much, may be a couple of lacks at the most. Still he sells around 4 flats per week. I gave him an offer to buy 5 flats at once and asked for 10 lacks Rs discount on each flat. He refused.

About rent: People post their ads on internal group and within hours their flats are taken. What you see on property websites are duplicate listings, unrealistic rent expectations etc.

Have you ever even invested anything in RE. If you dont want to invest, why wasting your time here???

I think your intentions are right, since you want to highlight the risk of leveraged investment, but your facts aint right.

Please do a proper homework before you talk about a specific project or property.

I wrote about PSN because I live here. Last time my flat was taken up on rent in 4 hours without the help of any broker.

If the commonfloor rents are unrealistic, then what is the realistic rent in PSN. Just wanted to know since I am looking for a flat for rent.

Thanks for the info.

Would you know how many units the owner is left with currently? Even if I assume it to be 100, will he post 100 listings in the commonfloor, considering that “He is not in rush to sell his flats.” ??

Or is it that there are more investor listings in commonfloor than the owner’s, in which case there are more flats up for sale than evident from commonfloor?

Considering that there are currently 570 units up for rent, some of them are obviously unrealistic expectations; owners reluctant to listen to market realities.

BTW, is the owner paying maintenance for ALL his units, because it has direct bearing to the upkeep of the project?

I live in mumbai and am interested to book a flat in Godrej united based on feedback I got from my relatives living in Bangalore.

What is the current price and availability in phase 1 and newly launched phase2?

Taking cue for builders quoted distances in advertisements, Godrej United is actually not far away from Mumabi, just 1 hr 10 mins*

*on a regular jet airways flight and not considering delays 🙂

u write because u have to write something 🙂 doesn’t matter if u have something to write o not

@SKS – @phase 1 the current rate is 5850 and in Phase one @5700 . Do mail me if you are still keen to book in this property .

Is the rate revised to 5850 ?

As I understand from the Marketing person, most of the flats are sold out when the launched it at 5000 per sqft. They immediately revised it to 5400, then 5600 and now 5850. Builder is in no mood to sell remaining units any time soon. Just looking for BAKRAS to make a handsome return.

They will get BAKRAS. Real estate investors have seen enormous growth in past 20 years. So they believe it will go up forever. These people will bet on a 100 yr old person , to live another 100 years.He has already proved the mettle right?

Dear Manjushree,

Greetings from Godrej Properties.

We have recently come across the posts here and hence thought of addressing these.

While we understand your concern, you would appreciate that the prices are bound to increase on achieving set milestones based on the revenue strategy of any business and the micro-environment conditions. It has always been our endeavor to communicate this to customers in a prompt and transparent manner.

For any further queries on Godrej United, we request you & all members to send your complete query to our customer response team email along with your contact details and help us to assist you in a better way.

Regards,

Godrej Properties Limited

If farmers say, you can pre-book rice/wheat during plouging phase at 40Rs per kg, price will increase at every milestone and during harvest 300 Rs per kg, no one can feed their kids in this country. I am trying to see which product is sold , even before its completed other than flats and what risks flat owners are taking on their own.

Wrong example!

san

I feel premium builders charge rediculously high amount .80L-90L for 2BHK in India? Looks like even in US you can purchase houses for this amount.

Population density of India is 10 times that of US 🙂

Considering comparable regions in India/USA from respective standards:

For same amount of land in we have 10 times more buyers in India 🙁

But do they have means to pay for it?

This is analogous to following situation:

If I go to a poor village to sell a diamond, there will be many who would like to own it. But not many will have means to buy it. Will the diamond sell at the same price as it sells in big cities?

I got it @ 5600 rate. i think its a good price for that area, even c grade builders are asking for 4000 rate !!!.

No tier A property is available less than 5.5k rate.

One of the best mall is at walkable distance. i am sure by the time it gets ready prices would be double.

I think its a very reasonable price from godrej, U can expect a reasonable appreciation may be 7000 -7500 at completion at least. For end use its perfect choice.

Investment its a decent deal, grade C builders are going at 3100 psqft. Grade B going at 3850 – 4000 psqft. So godrej at 5600 is very reasonable. U enjoy a great bend value and a premium location , y u want to give it to some one …:)

Do you math:

For 1Cr Fixed deposit, you can easily earn 60K per month (after taxes). Will you find anybody to rent your house at that price?

On top of it, you have taken bank loan, you will end up paying 1Cr as interest to the Bank. How long will it take to recover 1Cr if you get a rent of say 40K (impossible though): 21 years!!!

And you though, you can sell a 21 year old property at 3Cr????

Your are confused!

You are talking of I cr in a fixed deposit and then talking of a loan. If I have I cr then why will I take a loan.

Considering your theory of I cr in a fixed (which I will never put ) which will give your 60k per month and the property will fetch you a rent of 30k not 40 k

1 cr in fixed will become approx. 2 cr in 10 years cumulative if the rate of interest is kept same.

1cr apartment will fetch you approx. 50 lakhs in 10 years as rent, again keeping the rent same and adding the same interest to the rental income.

The average rate of Inflation in India is 8%for the last decade If we take the same for the next 10 years too. The apartment will cost 2.14 cr after 10 years

The currency can also depreciate to a average of 15% over the next 10 years

which will take the cost of the apartment to 2.29cr

Adding the Rent of 50 lakhs to this will make it 2.79cr

The apartment cost will keep in pace with the inflation of the country. The FD Capital will always loose value over a period since it is in INR.

And don’t compare India with US where the average inflation is just 2%

Also what you earn today is not what you will earn after 10 years. I may be wrong people can take informed decision see the past act in the present for a better tomorrow.

Todays Value will look big today and small over a decade. After a year people repent for what they did not do then.

In PSN when it was launched 2000 sqft apartment was available for 40 lakhs, Today it is more than a crore. Then If you had put that 40lakhs in an FD what will that earn for you after 10 years you can calculate and see for yourself.

If you are not an investor and going for your own use you have to buy according to your budget, requirement, and place. If you are brand conscious you will have to pay the premium. Don’t complain it is useless. Look for other options.

San

san

Not only am I confused but also shocked by looking at how existing “investors” are BLEEDING every day and the new, gullible ones are getting SLAUGHTERED in the name of “investment” by these shrewd builders. Not so much confused with my calculations though. Read on…

I have already explained this in terms of “opportunity cost” in one of my earlier posts. Find here:

http://harshasagar.com/2014/02/17/godrej-whitefield-road/comment-page-1/#comment-28517

Let me try to explain the same thing from a different perspective, so that it becomes easy to understand.

Math time:

————–

Say you want to make money by investing into something and you don’t have 1Cr cash in hand. Obviously, you approach a bank and take a loan, committing an interest of 72K per month (actually higher). At that point, as an INVESTOR, you MUST make 2 promises to yourself:

1) That I will make at least 72K out this capital to cover up the interest cost.

2) And that, I will never let my capital (of 1cr) to sit idle and try to make SOME amount after paying the interest. After all, anything above 72K is your profit and that’s why you are taking all this pain.

Both the points look obvious this far. What is not obvious is the MINIMUM amount you MUST be making in return of all the risk and pain you are taking. Now, how to calculate this minimum amount, or minimum profit to make this investment worthwhile? Let’s take a step back.

With 1Cr in hand, you have the option of investing it in hundreds of places. You may like to start a business with that capital. One of the options is to invest it in Real Estate. And the LAST and WORST of all the investment options will be to put this capital into an FD, earning an ASSURED income of 60K per month. So, in calculating our MINIMUM profit, this assured FD income of 60K is helpful, because this is the minimum GUARANTEED amount you will be anyway making by doing nothing. Obviously, your newly acquired capital MUST be making at least 60K per month (on top of 72K interest) to beat the profit from a lame FD. Anything more than 60K is worth the risk and pain you are taking.

Add 8K per month of maintenance cost for the apartment. So turns out, you should be making at least (72 + 60 + 8K) = 1.4L per month to make your investment worthwhile. Is this happening?

Ask yourself: Are you able to rent this apartment for 60K and will your apartment cost increase by (72*12) = 8.64 Lakhs per annum? If yes, only then you are making a PROFIT. You are a savvy investor in real terms. (I have not even included the TAX implications on selling your flat though)

Now, to conclude, in this stagnant market, Existing investors who are HOLDING on to their apartments worth 1Cr, and, are not even able to rent it for 40K, are actually BLEEDING at the rate of 1.4L per month!!!

Regarding your point about inflation of 8%, that’s applicable only on the INPUT cost, which I have calculated as maximum of INR 2000 per sqft. Read my post:

http://harshasagar.com/2014/08/10/purva-270-degree/comment-page-1/#comment-28463

Beyond 2000 per sq.ft, it’s HYPE, and you will agree that HYPE is not a component when calculating inflation numbers. So, with 10% inflation, prices must go up by 200 per sq.ft. per annum. HYPE is used to absorb the shock when RE market crashes. This HYPE part will diminish then.

Your point of currency deprecation is irrelevant, as both FD and apartment unit is in Rupee terms. Also, currency deprecation only adds to inflation numbers, which we have already factored in.

Some Hard facts:

———————–

EVEN if someone has bought in PSN at 2000 per sqft, by holding on to it, he is BLEEDING at the rate of 60K per month, which is eating into his profits. And the longer he holds, more he is loses. No surprisingly, he will be the first to “relieve” himself off this apartment unit when the market crashes. And for that he has to compete with another 450 owners, as I still see 450 apartment units up for sale in PSN, and that number is increasing….

Huh … doesn’t correlate well with your analysis….isn’t it?

Completely agree with Manjushree…and really impressed with her knowledge of maths and investment.

RE has to crash so that end users can enter the market and this doesn’t seem near possibility as these developers have already made lot of money and would not want to work on week margins post crash…they might look for another avenues and then we we see another generation of RE entrepreneurs entering the market.

I wish there is a ‘LIKE’ button in this page 🙂

Like Ms.Manjushree pointed out here, would like to stress that point again:

Property prices do not go up by inflation; rather they would go by supply and demand.

One is living in fools paradise if expect to beat this very basic economic principle.

A simple and obvious proof is to see the HUGE number of properties for sale on the different websites you get to see.

Property prices are being quoted based on inflation/ greed for windfall profits/ hype or whatever you call it; and are there any buyers at those price points? HA HA Check the property sale web sites.

Godrej property’s operating margin as per money control is between 17-32%. If flats are giving 30% or even 20% returns year after year to the owners why Godrej or any other real estate company is selling it in the first place. Even TCS margin is 25%.Tata could have bought only lands. Similarly IPOs, if they have very good companies,why dont convince a banker and fund their companies.Know the risk you take before putting money.

Waste analysis. you don’t need to read-write this complex economic funde to understand real estate benefits.

You are trying to make all the profit from rental income, however in india you get only 3-5% per year rent. you make money when you actually sell it.

Also you missed one very important point, in real estate you make profit on your money + bank money.

ex. in PSN few of my colleagues invested 10 lacs and took 40 lac loan

total 50 lac, that 50 lac became 1 cr today. so their minimum profit is 60 lacs from 10 lac in just 6-7 years!!

now you will raise money paid as bank interest: yes but then you anyway pay rent. rent + tax saving is approx to bank interest. few thousands + –

Can you make 60L from 10L in FD ?

don’t read those 1000s of article, apply common sense.

>>> ex. in PSN few of my colleagues invested 10 lacs and took 40 lac loan

total 50 lac, that 50 lac became 1 cr today. so their minimum profit is 60 lacs from 10 lac in just 6-7 years!!

>>>

Don’t you know ppl need to pay interest on the Housing Loan ??

For a 40 L loan for 20 years at a conservative interest rate of 10%, you need to pay Rs50L as interest to BANK.

Total payment to Bank = 40L (P) + 50L as interest in 20 year span

You are mixing 2 things, namely End_Users and Investors. If you have read carefully, my points are only about INVESTORS.

End users who bought at PSN for 2000 per sq. ft. obviously gained a lot. I am happy about those end users as they paid so less for such premium property and are living a good life today. I wish I were that fortunate.

About Investors ( Math Compulsory)

————————————————–

>>> rent + tax saving is approx to bank interest. few thousands + –

This equation used to hold true back than, when per sq. ft. rate was 2000. No more.

>>> you make money when you actually sell it.

YES. Very true. Ask those end-users at PSN to ACTUALLY sell those property at 1Cr and move to a SLUM area in a 20L property to “realize” a KILLING profit of 80L!!!

End users at PSN have to live somewhere and any other property of same standard will not cost less than 1Cr today. So, the profit you are taking about is only virtual i.e you can’t realize that profit. INVESTORS, whom I am taking about are looking for REAL profits.

>>> don’t read those 1000s of article, apply common sense.

Not sure what you mean by this one. Do you mean to say, STOP reading and start investing in Bangalore RE immediately as if there is no tomorrow?

Hi Ravi, how much interest we need to pay for 40 lakhs loan ?

from the houses I own and rent , i can always see its just 3-7 % return mostly due to increase in property prices

Houses are best only if we need to stay

the best way to get income from rent is buy a property 40×60 in bangalore , build your own apartment with 16 flats in it, you can still earn around 10% of your investment .

I couldn’t stop myself from responding to this.. there are valid points everywhere but in general i would agree with Ravi.. i have been in Bangalore for over 10 yrs and first bought an apartment in 2004, another one in 2008 that i sold off after couple of years and another one in 2012. At no point i could tell what would be the real prices after few years and always bought with intention of self use…..

But have to say that just the inflation and increase in cost of real estate has lead to significant price increase…. its probably true that PSN or other projects have tons of apartment on sales but its also equally important to find at what price??? one can say people are bleeding but i wonder why would 500-1000 owners keep bleeding and not sell. Logically there should be some apartments available at much lower prices which i doubt is the case.. and if there are some, i would definitely like to know where and how much lower !!

Supply demand equation is true and important but it would foolish to think that inflation doesn’t play a role..how is it possible that with cost of fuel, cement, labour etc going up over last several years, it won’t impact RE price? Similarly, builders do projects on borrowed money which causes huge interest costs….. again i am not saying that the price aren’t inflated at all but its hard to tell how much…even during times of recession which was pretty ugly, the property prices in Bangalore didn’t decline as much and i don’t think one could buy at around Rs2000/sq ft ever in last 5-6 yrs… one could say that its cos NRI etc were invested but then where’s the data to suggest that?

Folks are missing a very relevant and important element called “leverage” that Ravi mentioned which comes from borrowed capital .

For example, the EMI I pay for my flat that i purchased in 2004 is lower than the rent i can get anyday…. so in that sense, from this point on, i am not paying anything “additionally” to won the flat.. its basically bank money which i used and in true sense all i paid is 20% down payment and EMI over last 10 years which in total is lesser than the original cost of the apartment !!

Another fact is that residential property is not meant for rental to generate profits in the first place..definitely not so in first 10 years or so —— if that’s what one wants,then commercial property is a better investment or rather a different asset class…. a good mutual fund investment you give 10-12% YOY return over a 5 yr period.

also, residential property carries what i call a usage and emotional value beyond just financials which is probably hard to quantify.

I think unless you have the appetite, residential property shouldn’t be looked at investment to generate profits till the point where you actually sell it.. also, usually one needs to price little below the market rate when trying to sell an apartment or else no one would buy a used apartment when there’s so much availability everywhere.

net net… use your common sense, look at your affordability, market price, location and decide what makes sense for you considering how important it is for you to own a home… End of the day its not really a bad idea to stay on rent for whole of your life and invest aggressively elsewhere to create wealth and mange risk…

A builder will always sell at the price they can which is market driven and to some extent their own costs and margins but just like you cant control any of that for most products you buy in your life, you can can’t control or sit and wait forever waiting for a RE crash…

these are my thoughts based which are based on my experience, logic and practicality….

Dear manjushree

I have read through your analysis and it does hold good if one is indeed buying a completed aprt/property’s as an INVESTOR but most savvy investors (me included) , will NEVER buy a completed aprt as a investment! We get in during pre launch and get out in around a year’s time.

For ex if a 1000sqft aprt is prelaunched at rs 5000psft. We put 10 lacs (20%down ) , pay 3 installements ( wait for the aprt to touch 5500 ( likely within a year ) and then exit. Our return will be 5lacs on a 10 lacs investment in a year’s time ! Beat that!

( in reality we may sell it for lesser than 5500 for a quick exit but nevertheless , it will beat a base return of a 70k annual return on a 10lacs FD, hands down! So therefore 3-5lacs return vs a 70k return on 10 lacs = a savvy investment !

( P.S : have not taken the 3 instalment costs and have assumed a “cash” exit but that shouldn’t tilt this analysis by very much, as i have made a general point regarding residential real estate investment 101. Also, it is RE 101 that a residential investment will give you only 3-5% returns but then real carrot dangling is the “potential” capital appreciation in that.

I would also not recommend mindless speculation based on the above example as real estate is market driven and the market is slowing down with inventories rising so consequently exits will take longer, but if you have the power to hold even during the downtimes, then it is a great asset class to be in as our country is a burgeoning economy and the need for quality housing will eventually hold out.

Also, going on a tangent here, I see so many people trashing so many projects( prestige tranquility etc), know one thing, genuine savvy investors are just silent readers here, if at all!, and don’t really care about trashing projects /commenting here and wasting time posting 2 bit comments… Btw , have taken 5 min to post and will not be pulled into a unproductive debate here. Felt indebted to the bangalore real estate market for making me a millionaire but as always, do as you all deem fit.

Happy investing!

Cheers!

Arjun

( I run a VC firm that invests in various sectors including real estate and till date the CAGRs on our RE investments have given us extraordinary returns!)

Hi Arjun,

While I am not an expert of RE market in BLR , I have 2 observations in your analysis above :

1) No Tier-1 builder will allow exit after 1 year. Most of the new pre-launches have atleast 2 years and/or 50-70% payment lock-in

2) Transfer charge is not taken into account above. . . they might run upto 150 psf . .

Well said Arjun. Taking a home loan to invest in a property is strict NO-NO. Its like taking a loan to invest in IPO. If you are cash rich and able to hold on to a A/A+ property for first 2-3 years from pre-launch with just cash,then RE is the right investment ground for you. But again, like stock market, RE is also bound to ups and downs and its in downward trend today. However I am not sure if it is bottomed out. But I feel it will bounce back in medium term.

@Arjun

Quite possible: many savvy investors are actually doing the same. From your 5L gain, deduct:

1) FD interest on down-payment (opportunity cost, 70K for 10L)

2) Transfer charges (builder’s cut on your gain, 50K)

3) Short term capital gain Tax (government’s cut, @30%, ~1.5L)

4) FD interest on installments (Opportunity cost, say 0)

5) Bank loan interest (if applicable) (Banker’s cut, say 0)

6) Brokerage while selling ( another cut, 1-2% of sale value, 1L)

Even after so many CUTs, you will be left with 2.5 to 3L of ANNUAL profit, not bad: around 27%. You beat the FD for sure!!!

This is the gain if you actually SELL the property. If not, it’s going to leave you with the wound that is going to BLEED you for years …..

But wait, there is more to this 5L story before you conclude, continue reading …

A subtle but important thing to note here is that Arjun is not another investor, who is working in IT and investing in RE while moonlighting. As he claims, Real estate investment is his PROFESSION, and as a result he draws his salary from the profit he makes. After all, to make such quick buys and sells, one needs to dedicate a lot of time and it has to be done PROFESSIONALLY. So to reach the NET PROFIT, we must deduct some fraction of his annual SALARY from this profit. Equation will be:

(Profit from Real Estate) – (X % Salary) = NET PROFIT from RE

>>> Btw , have taken 5 min to post and will not be pulled into a unproductive debate here.

Need I say the least: 5 minutes of time here on this forum is costly and unproductive, we can only wonder, how much will his annual salary be to impact the NET profits. Anyway, that’s his BOSS’s concern.

>>>> Felt indebted to the bangalore real estate market for making me a millionaire

…. You should be, after all, it also gave you what you call your PROFESSION.

Are you an Investor !

san

Hi Arjun/all,

Can we sell the property while it is in pre launch. I asked the sales executive, he said you can only return the property and cannot sell it.

Please advise.

Hi please let me know contact person from who booked . interested for 2 bhk apart.

hi Abinas – please let me know your contact or send me mail. will help you get the beat deal.

Dear Abinasroy,

Greetings from Godrej Properties Limited!

Thank you for expressing interest in Godrej United, Bengaluru.

We would like to request you to kindly share your contact details on , so that we can assist you in taking an informed decision.

Alternately you can contact us on our 24*7 Toll Free number 1800 258 2588 for further details or chat with us anytime on our website http://www.godrejproperties.com

Godrej Properties always believe in a relationship based on trust with our customers

Regards,

Godrej Properties limited

Exactly the point. IN that stand we need to have rentals also in the range of 60 thousand 1lak all over the cities. Cannot happen unless income of people adjust to US standards,which we know will not happen anytime soon.

Individual income might not be same as US standards but many families has income in range of 1.5 – 2L per month.

Thats the reason you see good number of buyers for these properties.

Already rent in PSN, Brigade etc is 35k for 3bhk. And it will continue to go up!!

If rents in PSN were to go up further, there would not have been 521 units lying vacant for rent.

Please check this link for number of apartments available for rent and sale at PSN:

http://www.commonfloor.com/prestige-shantiniketan-bangalore/povp-s6yjsx

Agree that, going by capital valuation of their apartment, Owners are asking 30-32K rent, but there are not many takers. Otherwise 521 units would not have been waiting for tenants. Those who could afford, are already renting or are staying at their own house. But still, the fact remains, MOST of the apartments in PSN are waiting for tenants!!!

Some more math:

If a owner is holding a 1Cr apartment at PSN which is lying vacant in search of a tenant, he is losing at least 60K per month of fixed deposit income. On top of it, for a 3BHK unit, he is paying at least 8K as maintenance which is essentially going down the drain for him. Now consider if he has gone for bank loan. Interest on 1Cr will at least be 72K per month. So, essentially, by keeping this apartment, he is losing at least (60+8+72) = 1.4L per month..!!!!!!

Only reasonable thing for him now is to sell this property at a lower price, and look for other investment avenues. Bangalore Real Estate a HOT investment….no more!!!

Above calculation has some flaws

1) 521 flats vacant doesnt mean that all are available for rent/sale. There are quite a few NRI/Non-NRI who holds the flat without desire of renting or selling. In my current apartment, I can see atleast 10 Apt lying in this. Mind you my current Apt is mid-segment (Avg price is 40L)

2) You are assuming that person holding 3BHK has bought flat @ 1 Cr. Hence you are doing calculation of 72k EMI. It is very likely flat was bought at lower rates (3000-4000 per sq ft) from Prestige. Hence whole loan calculation is wrong

3) Some flats could be of landlord, who doesnt have need to sale always. Whenever there is need of money, they will sell at their rate.

4) Bangalore has enough number of high income people who are not so money math minded. Yes it is bad, but due to these people Market doesn’t come down. Personally know few colleagues who holds 2 or more flats in bangalore. Both lying vacant and persona staying in rented apt due to own preference 😀

>> 1) 521 flats vacant doesnt mean that all are available for rent/sale.

They are specifically listed for rent on commonfloors.com. Why otherwise would anyone list his property for rent if he doesn’t want to rent it out anyway….that too, many are premium (paid) listings..!!!

>> It is very likely flat was bought at lower rates (3000-4000 per sq ft) from Prestige. Hence whole loan calculation is wrong.

Even if it’s bought at lower rates, if the market valuation of the flat is 1Cr, he is losing money at the same rate…this is called “opportunity cost” …i.e….by holding this flat he is losing out on the opportunity of earning assured FD income of 60K per month unless flat price is increasing enough to offset that loss. We know that’s not happening: flat prices are mostly stagnant when it comes to YOU selling it. If you are an investor, this is how profit and loss are calculated. Ask your friends in finance.

>> Some flats could be of landlord, who doesnt have need to sale always.

Same as above, losing on “opportunity cost”.

>> Bangalore has enough number of high income people

Wasn’t it the same story in US, where I suppose RE market crashed post 2008 recession. Agree that because of high demand, RE market may not crash drastically in India, but investors money will be blocked for a long time in a stagnant market, increasing the opportunity cost further.

Contrary to what many believe, a crash in RE market will actually be healthy. It will lower the barrier for new investors/end users and increase the economic activity around RE business. Stagnant market as it’s today is not good, neither for investor nor for developer nor of the economy as a whole.

Why are you beeing soo critical. Your claims on an FD is reasonably good but is it really good to compare Fd with real estate? real estate is a solid asset ,it beats inflation and generates a fixed income in long term. The property cost will adjust for inflation which the FD too does.

Rental income 3% – 5% of the property cost will not drop down. About the property prices you are mentioning, yes i agree it is slightly high. It is because majority of the buying happens from the IT employees who make 3 Yr -5Yr US trips and have a liquid cash of 50-80 Lacs. So thay want a reasonably good investment. But its true they pay a bit higher cost compared to value. Investors are the most schrewed of all, Investor appartments are moving like hot cakes ,trust me. But the genuine buyers who try making an investment out of an appartment are facing heat when it comes to selling , its not easy to resell single appartments at 1Cr when u have 1Cr brand new appartments offered from builders. Happy buying guys.

Thr r many flaws in his math. Firstly when if someone has 1 cr then why need to pay interest but ur calculation shows 72k interest payment on so only 60+8k =68k which is yearly around 8.1 lakhs but at simple appreciation of 10 percent property can appreciate by 10 lakhs plus 25k rent will be saved which is 3lks so 10+3=13 lakhs’ which is stil 5 lakhs more than Fd. I have not considered inflation which will increae rent and property on yearly basis. Plus you have a stisfaction of your own house.

Ashish, she is telling about flat as an investment

If its for end use we anyway have to buy one

It was probably for this reason that our very own dear Mr Shibulal (former CEO of Infosys) choose to buy around 700 apartments in and around Boston. He was trying to bring Indian culture and mindset to US – use real estate only as investment. In the US, most people just buy one good house for own use, which helps to control un-realistic price increases.

This logic is flawed. Yes you may get a great deal for 90 Lakhs equivalent in Florida but you won’t even get a place on the footpath in San Francisco or in Manhattan for that money. So it depends on the location, on the location, on the location – as the saying goes, in every country in this planet.

Yes, you’re right!! location matters. & you can’t compare a location in Bangalore with another in SF. Bangalore, a poorly designed self imploding city is like a loo when compared to SF.

Hi,

Anyone knows whats the resale clause? Can we sell the flat at anytime? Is there any charge/fees for transfer? Is this a good property for investment in 5 yrs time-frame?

Dear Ronak,

Thank you for your interest in Godrej United Residential Property in Bengaluru and taking your time to write to us.

We at Godrej Properties always believe in a relationship based on trust with our customers. For us, ensuring customer satisfaction is of utmost importance. So we would like to clear your doubts and queries that will help you make an informed decision.

We have recently come across the posts here and hence thought of addressing this.

As per your query, we would like to inform you that as per the release clause, a certain transfer fee per sq. ft. of saleable area will be charged till possession. Moreover, the transfer will be permitted only after receipt of minimum of 50% milestone payment as per the construction linked payment plan or 12 months from the date of booking, whichever is later. May we request you to kindly get in touch with our customer response team email to get more details on the transfer charges?

We strongly believe that it is a good opportunity to invest in Godrej United, given its location, amenities and the surrounding infrastructure.

We hope that your queries have got answered now but if you have any query in future you can feel free to write to us on our customer response team email along with your contact details.

We will be present here to provide our assistance to your utmost satisfaction so that it will help you make an informed decision.

Regards,

Godrej Properties Ltd.

Did any one calculate the efficiency in this project? It is ridiculously low just 66 percentage. Guys think before investing such properties may be dreaming of having 3 bhk of 2100 sqft but u would not get more than 1386 sqft this the worst carpet area given by any premium builder in Bangalore . I know it is ur money just sharing my thoughts

Dear Abc,

We appreciate the observations you have made regarding the Godrej E-City property in Bengaluru. We understand your concerns regarding the carpet area and regret that your initial observation of the project has left you disappointed. May we kindly request you to contact our customer care team on the coordinates mentioned below to get an accurate understanding of the matter raised by you.

Godrej Properties prides itself on the high quality standards followed for project execution, materials and services. We ensure that the designs of our projects are innovative and unique. We focus on customer requirements and ensure that we incorporate them in our designs. Our flats are designed to provide immense aesthetic value as well as privacy to the residents.

We would like to inform you that we are offering various area options: 1BHK-615sqft; 2BHK-1338 to 1799sqft; 2.5BHK-1459 to 1544sqft; 3BHK-1933 to 2173sqft; 3BHK (Premium)-2619 to 2700sqft; 4BHK-2949 to 2956sqft; 4BHK (Duplex)-4337; 5BHK (PH)-6290sqft where all properties are currently priced at Rs5700 per sqft. We assure you we have properties above 1386sqft carpet area as per your requirement.

We would be glad if you would contact us with any further queries or doubts and hope that we can answer them to your satisfaction and help you make an informed decision. Please contact our Customer Response Team at and they will be glad to answer your queries.

Regards,

Godrej Properties Team

Dear Godrej Properties team,

Please stop replying just for the sake of doing so. The question was on % of carpet area, and the reply was that you have apartments greater than 1386 carpet area…ridiculous ! What is the carpet area for your 3 BHKs (1933 & 2173) in Godrej United project not e-City?

Such out of context replies would not help to demonstrate that you are a ‘customer friendly’ organization. Also, few other questions from my side:

1. When would be the launch of Godrej United?

2. When would the model apartment be ready?

Thanks

Dear Bikram,

Thank you for expressing your interest in Godrej United Residential property in Bengaluru and also taking your time to write to us.

We at Godrej Properties always believe in a relationship based on trust with our customers. For us, ensuring customer satisfaction is of utmost importance.

As per your current requirement, we have two options in 3BHK-1933 to 2173sqft and 3BHK (Premium)- 2700sqft. Wherein for the former the carpet area is 1378 – 1525 sqft and for the latter the carpet area is 1884 sqft.

Kindly note that the carpet area for the units is between 70-72% depending on the unit type.

The project will be launched in August 2014, tentatively. We also expect the model apartment to be ready before that.

We hope that your queries have got answered now but if you have any query in future you can feel free to write to us on our customer response team email along with your contact details.

We will be present here to provide our assistance to your utmost satisfaction so that it will help you make an informed decision.

Regards,

Godrej Properties Ltd.

Hi Godrej team,

Your statement “Project launch in August and model flat will be ready even before that”. It’s already September.

I really wonder how customers can trust you. Marketing ppl should learn to provide true details.

I was told that all 2bhk and 2.5bhk are sold out.. do they mena all 2bhk are sold our or only the ones they planned to sell in pre launch? What is expected price at launch?

Hello Vasu,

They mean what they wanted to sell is sold. Expected launch will be 5600+.

-Amit

The price is already 5550. Once all documetns are ready and home loan approved by banks like SBI, the launch price would be 6200+

So better to book a 3bhk now rather than wait and book a 2.5 after launch.

That;s my view based on other projects I explored in past (and ended up not investing in those projs)

@kumar.

Do you know when is the launch.

Your suggested launch price of 6200 is very ambitius. They were finding it hard to sell after the initial bookings for 5000 and 5250 @5400.

In real terms 6200 would mean a jump of almost 25% for people who have booked at 4999 by paying only the 20% booking amount. I dont think any builder in BLR could provide that kind of return

your logic about percentage jump sounds correct. but price at launch time would be based on market price. I do not see any other project from Class A builders with similar location & amenities at a price lower than 6200 psft.

Are you related to Godrej or United Oxygen? I am getting calls daily from these folks about 2.5 & 3bhks, ofcourse everything is sold out, very few units are left, then why they are calling back? If they increase the price by even 1 paise, I dont see it getting completed in atleast 10 years.

@Amit, @kumar, @VJ, @Not_an_investor: Thanks for your responses

Dear Not_an_investor,

We appreciate the observations you have made regarding the Godrej United property in Bengaluru. However, we request you not to give out misleading information to others. We understand your concerns regarding properties not being available and sold out and on the project completion date. However, we assure you that currently we are offering 1BHK-615sqft; 2BHK-1338 to 1799sqft; 2.5BHK-1459 to 1544sqft; 3BHK-1933 to 2173sqft; 3BHK (Premium)-2619 to 2700sqft; 4BHK-2949 to 2956sqft; 4BHK (Duplex)-4337; 5BHK (PH)-6290sqft where all properties are currently priced at Rs5700 per sqft and the tentative date for project completion is in July 2016.

If you have any further doubts/queries you may send in your queries to our Customer Response Team on and they will be more than glad to answer your queries and help you with your decision.

Regards,

Godrej Properties Team

@ Godrej Properties Team, Appreciate your concern and presence here. But you should consider that this is a public forum and not an advertisement for Godrej properties and pay due respect to people over here as well. Please let me know what misleading information did I give to people over here. I just told from my personal experience. You can go through my comments and let people know what are the false comments made by me. What about the guys spreading starting price of 6200 psf? Or was that you guys just judging the market? Now tell us more realistic picture here, is the project launched? Is model flat ready?

Dear Not an Investor,

We have recently entered the Customer Response Arena and we aim at addressing all customer queries. Also we are always open to feedback from all users to make our services most customer-efficient.

Our response was in no intention to disrespect any User/ Advertise our property, but to put across the correct information for the benefit of all.

Further, we ideally would not want to put consecutive posts under a common thread to create any kind of inconvenience to moderator and other forum users. So we would like you to send us all your queries mentioning your full name and Contact details to our Customer Response email so that we can assist you to your satisfaction.

Awaiting a positive interaction with you

Regards,

Godrej Properties Team

Tell us when r approvals expected ?

6200 is the base price. Including service tax vat and other charges it will be above 8000 psqft. For the resale flat there will not be any charges or tax. Mostly resale flats are semi furnished which is worth 300 to 500 psqft.

Refurbishment can be done to bring new look with 200 to 300 psqft.

Now. Can u please tell us which A class ready to occupy is priced more than this.

No project priced 25% diff for pre launch to launch.

If builder done so, then the sale at pre launch price is done for themselves.. No real, end user might have got at that rate. Even if they sold to an end user the numbers might be 5-10. Just a trick to fool the buyers.

>>No project priced 25% diff for pre launch to launch.

ROW is one recent example where prelaunch was at 4100 and launch was 5200+ (more than 25%)

>>Can u please tell us which A class ready to occupy is priced more than this.

All, as per my knowledge. Brigade metropolis, PSN

I booked after doing my research. Before that I followed and observed many pre-launches and launches only waiting for prices to fall or at least stagnate.

Other people should also take a call after their own research. However as some one asked for suggestion on price I told as per my analysis, u r free to have a different view 🙂

ROW prelaunch was in March 2013 and launch was in Feb 2014!

Do you think, the quoted price in websites for PSN and Metropolis are the price they actually get sold for?

Also going from 4100 to 5200 is different than starting at 5200 and gng till 6200 🙂

@ Kumar, @ Sanjay be true godrej/united representatives and answer our queries rather.

If u done the analysis, pls quote the numbers. Max asking price for those PSN and BM are. 7500 to 8500.

With base price 6200, plus other charges will be 25% of base price. Means 7700+. Other charges are, clubhouse, PLC, floor rise, car park, bescom, water, etc.

Also add service tax, vat.

Tell me what’s the Cost to Own a flat in godrej and in brigade. Take typical size 1300 sqft

Guys, You have so many options in and around whitefield, @5590 DNR Atmosphere, @ 4950 Spectra Palmwoods, @4800 Gopalan Atlantis, @5500 Skylark Esta.

and ofcourse the quoted prices are negotiable also 🙂

If you interpret “investment” as monetary ROI after X number of years then all the above projects namely BLF,Godrej, BM and PSN are bad investment choices going by the current rates ..BUT if your expected return is in terms of “Living Experience” then these projects will definitely be good investments…recently bought a 3bhk resale in BM ~@7150 psft, really happy about the decision.

P.S: I feel construction quality of BM is better than PSN, not to sure if Gopalan or Skylark can be clubbed along with the above projects going by quality of already executed projects, Spectra and DNR are unknown quantities

@Sushil, Are you sure BM and PSN construction quality are really great! If you consider amenities both are great, I rate PSN more than BM, but in terms of quality both are equally bad. Gopalan and Skylark quality are comparable with both BM and PSN (I am saying the walls within which you leave and not in terms of amenities). DNR is unknown for sure, but Spectra quality is much better than both BM and PSN, please go and visit Spectra Cypress and check for quality. Then you compare the flat you bought in BM at the insane rate!

@ Sushil, Congrats on your purchase! and I am just saying my opinion, but 7150, you could have got some Villa man!

Hi Kumar,

I saw yuor comments for streling feedback page also that : “I am one of the buyer in sterling shalom phase 2 who booked flat in 2011 March, but still not even 70% of the work is completed”.

And you have booked now godrej united? Can you please let me know which one is better option ?

U seems to be new in real estate …

Just wait and watch for launch above 6200 psf !!

@Sanjay

Good to here about your expertise in Real Estate. Seems like your really have good knowledge also may be well connected to the builder to say something with so much confidence. Are you saying this on behalf of the builder.

The other question is when is the launch, 1 month, 3 months, 6 months, 12 months

I see that rate in the horizon of 6-12 months, so you could technically be true. But then it just means, that the developer is taking that much more time to sell the 10-20% released for sale of the total inventrory. Most projects would go for launch in the range of 3 months from the prelaunch

@V J

I am following Bangalore real estate for 3 years now and m sure i have much better knowledge then you on any given day !

As godrej sales guy say project will launch by june …i say they will for sure launch before july !

When u visited the site last time ?? i guess never !! Sample flat is almost ready .

Y price will be close to 6000 psf at launch ??>>> I will give u only 1 reason ie LOCATION LOCATION LOCATION !!

Vj i can understand u missed the opportunity to book the flat @ pre launch price (4999psf) but trust me even if u book at present rate u will get good profit.

Hello All,

I have been in Bangalore real estate for 5 yrs now , Demand and supply is pushing prices of real estate up daily .

Something which is in city , well connected and near to office space will always have demand.

Having Brand Name is a big plus , also when we know it will take 3 yrs to complete we dont have big burden on Pocket to go ahead and book it .

From all these angles and also from Near by good projects Brigade & Prestige Shantiniketan are already close to 7000/- psft and are already 5-6 yrs old . By the time Godrej is ready they will be 8yrs+ old . So Godrej may be selling @same rate as these projects.

Just my view .

Thanks,

Amit

@ Amit I dont agree with you on this at all! PSN and Metropolis are not at all gng at 7000 psf. Dont get fooled by the rates shown in sites. Consider Sobha habitech, you can get it for decent price from some brokers/owners at ~5500 psf, anyday better!

5500 is only the base, you will have other charges like floor rise, club house, car park , VAT and ST which is in addition to the base price. You can add 22% to the base price to arrive at the total Price.

San

@san, I am talking about base value of 5500 only, but even if you add all other stuff, do u think it will come to 7000? You are talking about base price of 6200+ for godrej! So compare apple to apple.

A sobha apartment will cost you approximately 32% on top of the base price Including the registration without any interiors, if you have bought one you can calculate and check the same. I am telling this since I have bought one and it costed me around 32% on top of the base price.

San

@ san, some statistics can be completely misleading. Just check with latest apartments from Sobha eg:- Habitech, Marvella. Also I am not sure what negotiation you did with Sobha! Anyway I am not an owner of any Sobha apartments so I can’t comment with same level of expertise as yours. But check the market right now, you will be surprised.

@not_an_investor

As posted earlier bought a resale at BM @~7150, forget 7000 the rates are definitely going @7100+, ask any recent buyer who bought in BM or any prospective buyer currently negotiating and they will concur with the posted rates…btw how did you arrive at the conclusion that it isnt going at 7000+? did you actually negotiate or was it just an assumption?

@ Sushil, Thats insane rates you have paid if you have bought in actual. I too did negotiate and I had written from my experience.

@not_an_investor

So when did you negotiate and what was the final quote? was it a 1297 or 1610/1630 unit?