A lot has been written about Systematic Investment Plans & Systematic Transfer Plans. Whereas it is completely true that SIP is one of the best and safest ways to tap the markets, there are some innovative products in the markets which you should definitely evaluate. One such is a Flexi STP currently offered by HDFC called the “HDFC Flex STP”. A Systematic Investment Plan allows you to invest a fixed amount of money at fixed time intervals. A Systematic Transfer Plan allows you to transfer a fixed amount of money from one fund to another. So what is Flex STP?

A Flex STP does not always involve a fixed amount, but the fixed amount will be the minimum amount that will invested. The actual amount that will be transferred to the target fund varies along with fluctuations in the market, the beauty of the product is that when the NAV of the target fund falls the investment is accelerated to take advantage, whereas when the market keeps moving up a minimum amount is always invested so that you don’t miss taking advantage of further rises.

Lets take HDFC Flex STP as an example. You have an investment amount of Rs.100,000/- that you would like to invest. A wise decision is not to invest this amount into an enquity fund as a lumpsum to protect yourself from price fluctuations, but invest this into a Debt Fund and setup a STP to an equity fund. Lets compare the performance of an STP and a Flex STP over a 6 months period.

Case 1:

You setup a normal STP that transfers rupees 5000/- every month from the Debt Fund to an Equity Fund.

At the end of 6 months

Total Units Purchased :3083.32 by investing a Total Amount of Rs.30,000/- indicating an Average Purchase Price of 9.729

Case 2

You setup a Flex STP with Minimum STP Amount as 5000/-.

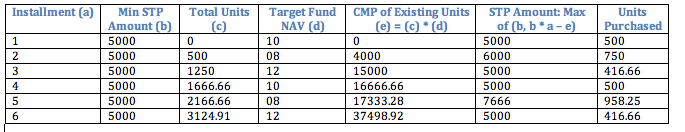

The STP amount for a month is calculated as the Maximum of (Min STP Amount, Min STP Amount * Installment – Current Market Price of Existing Units in the Target Fund). From the table below, the STP amount for the 2nd month would be Maximum of (5000, 5000 * 2 – 4000) = 6000/-

At the end of 6 months

Total Units Purchased :3521.57 by investing a Total Amount of Rs.33,666/- indicating an Average Purchase Price of 9.559

Learnings from Flex STP

- The average buying price of a mutual fund unit over a period of time is is lower than one in the normal STP

- The monthly investment varies according to market movements